A Complete Guide to Investing in Commercial Real Estate in Pakistan

Commercial real estate has become one of the most reliable ways to build wealth in Pakistan. Whether you’re a first-time investor or someone looking to expand your portfolio, understanding the basics of commercial property investment can help you make smart decisions that pay off for years to come.

What is Commercial Real Estate?

Commercial real estate refers to any property used for business purposes. This includes office buildings, shopping centers, medical facilities, warehouses, and retail shops. Unlike residential properties where people live, commercial spaces generate income through rent paid by businesses and organizations.

The best part of commercial real estate lies in its potential for steady income. When you own a commercial property, businesses lease your space, providing you with regular rental payments that often exceed what you’d earn from residential properties.

Why Invest in Commercial Real Estate in Pakistan?

Pakistan’s economy continues to grow, and with it comes increasing demand for commercial spaces. Cities like Islamabad are expanding rapidly, creating excellent opportunities for property investors.

Here are some key reasons why commercial real estate makes sense:

Property Value Growth: As cities develop and infrastructure improves, commercial property values tend to increase significantly over time.

Higher Returns: Commercial properties typically offer better rental yields compared to residential properties. While a house might give you 3-5% annual returns, commercial spaces can deliver 8-12% or even higher.

Long-Term Leases: Businesses usually sign longer lease agreements, sometimes for three to five years. This means you get a stable income without constantly searching for new tenants.

Professional Relationships: Dealing with business tenants is often smoother than managing residential tenants. Businesses understand contractual obligations and maintain properties well.

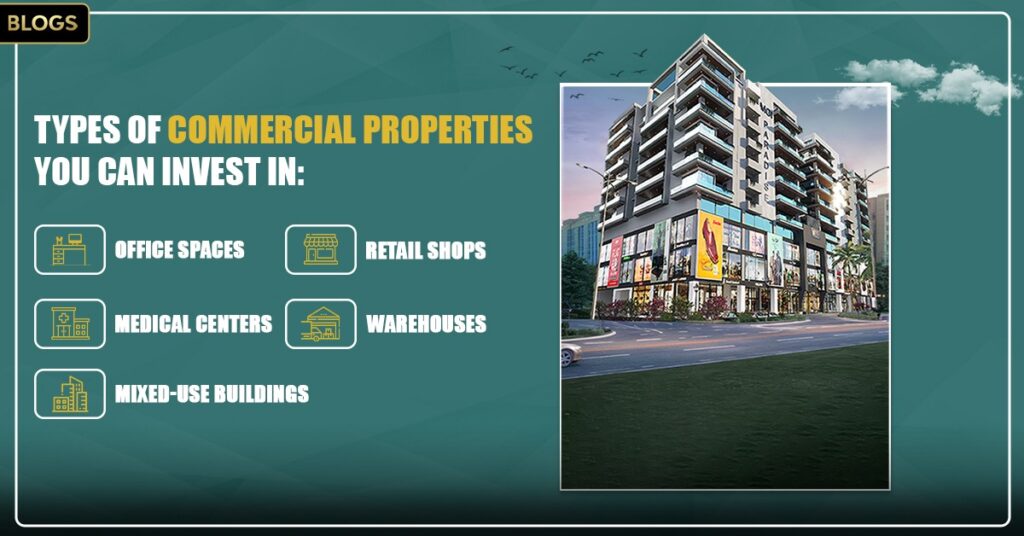

Types of Commercial Properties You Can Invest In

Understanding different commercial property types helps you choose what fits your budget and goals.

Mixed-Use Buildings: These combine different uses, shops on the ground floor with offices above. They spread your risk and can maximize returns from a single property.

Office Spaces: These range from small offices in shared buildings to entire floors in corporate towers. Office spaces work well in business districts and are always in demand from companies of all sizes.

Retail Shops: Stores in busy markets or shopping plazas can be highly profitable investments. Location matters most here; a shop on a main road will always attract tenants willing to pay premium rent.

Medical Centers: Healthcare facilities like clinics and diagnostic centers need specialized spaces. Several companies have recognized this growing sector, understanding that medical commercial real estate offers unique stability, as healthcare is always in demand, regardless of economic conditions.

Warehouses: With online shopping growing in Pakistan, warehouses and storage facilities have become increasingly attractive investment options. E-commerce companies constantly need space to store their products.

How Much Money Do You Need to Start?

You don’t always need to buy an entire building. Many investors start by purchasing a single shop or small office space. As your investment grows, you can expand your portfolio.

Wondering how to begin? At MGi Paradise, investors can purchase individual shops, office spaces, or luxury apartments tailored to various budgets and investment goals. Generally, expect to invest anywhere from tens of lakhs to several crores, depending on location and property type.

Banks in Pakistan offer commercial property loans, although the requirements are stricter than those for residential mortgages. You’ll typically need to provide a percentage as a down payment and show proof of steady income.

Finding the Right Location

Location determines everything in commercial real estate. A property in the wrong area will struggle to attract tenants, while a well-placed space will rarely sit empty.

Look for areas with:

- Consistent public presence and easy accessibility.

- Good road connections and parking availability.

- Growing commercial activity and development.

- Proximity to residential neighborhoods or business hubs.

- Available utilities include electricity, water, and internet.

In Islamabad, prime commercial areas include Bahria Town, DHA, Blue Area, and F-sectors, offering high business visibility and growth potential. Projects like MGi Paradise are emerging as attractive options, combining strategic location with modern amenities designed specifically for medical and commercial use.

Understanding Legal Requirements

Before investing, familiarize yourself with Pakistan’s property laws. Always verify ownership documents and ensure the property has a clear title. Check with your local development authority about:

- Proper commercial zoning approvals.

- Building permits and completion certificates.

- No-objection certificates from relevant departments.

- Property tax records and utility bills.

Hiring a reliable property lawyer is money well spent. They’ll review all documents and ensure you’re making a legally sound investment.

Managing Your Commercial Property

Once you own commercial property, management becomes crucial. You can either handle it yourself or hire a property management company.

Good management includes:

- Finding and screening quality tenants.

- Collecting rent on time.

- Handling maintenance and repairs.

- Ensuring tenant satisfaction.

- Managing legal and tax obligations.

Many investors prefer professional property managers, especially if they own multiple properties or live far from their investment.

Risks to Consider

Every investment carries risks, and commercial real estate is no exception. Economic downturns can affect businesses, leading to vacancies. Construction quality issues might require unexpected repairs. Market conditions can shift, affecting property values.

Reduce risks by:

- Research thoroughly before buying.

- Diversifying across different property types.

- Maintaining emergency funds for repairs.

- Building good relationships with reliable tenants.

- Staying informed about market trends.

Conclusion: Getting Started with Your Investment Journey

Commercial real estate in Pakistan is growing fast and creating real opportunities for investors. Are you ready to begin? Start by educating yourself about the market and visiting commercial areas in your target city to gain valuable insights.

At Medic Galleria International (MGi), we specialize in commercial real estate with a proven track record of 6 completed projects, 4 in Pakistan and 2 in the UK. Under the visionary leadership of Mansoor Shafique, we’ve consistently delivered projects that exceed expectations. Our flagship project, MGi Paradise, offers modern infrastructure, a prime location, and the potential for steady rental income and long-term growth.

Success comes from making informed decisions and choosing the right partner. With Pakistan’s expanding economy and urban growth, now is the perfect time to take your first step toward building lasting wealth through commercial real estate. Let MGi guide you on this journey.