Real Estate Sector Developments After PSX 100 Index Update

Introduction

The recent surge of the Pakistan Stock Exchange’s KSE-100 index past the 103,000-point mark has ignited optimism across various sectors, particularly in the real estate sector. This milestone, representing a significant upward trend, reflects growing investor confidence and a more stable economic environment. With the KSE-100 index experiencing a remarkable increase of 60.26% since the beginning of 2024, it indicates a strong recovery from previous downturns. As the stock market flourishes, the real estate market is poised to benefit, with projections suggesting that it could reach an impressive US$1.98 trillion by 2024. The residential sector alone is expected to dominate this growth, reaching approximately US$1.28 trillion. This article delves into the developments in the real estate market following this significant update, focusing on trends, challenges, and opportunities for both new and seasoned real estate investors.

Understanding the Real Estate Market Post-PSX Update

The rise in the KSE-100 index not only signifies investor optimism but also highlights the interconnectedness of different sectors within the economy. As the stock market rebounds, it typically leads to increased disposable income and spending power among investors, which directly influences the real estate sector.

Key Data Points in the Real Estate Market

1. Market Size and Growth Projections

- The real estate market in Pakistan is projected to reach US$1.98 trillion by 2024, with the residential segment valued at approximately US$1.28 trillion. This growth is driven by urbanization, rising incomes, and an expanding middle class.

- The overall real estate sector is expected to maintain a steady compound annual growth rate (CAGR) of 4.01% through 2029, potentially reaching US$2.41 trillion.

2. Rising Urbanization

- As urban areas continue to expand, the demand for housing is expected to increase. Currently, around 37% of Pakistan’s population resides in urban areas, a figure that is projected to rise to 50% by 2030. This demographic shift creates a pressing need for residential developments, making the real estate sector a focal point for investment.

3. Investment Trends

- Recent trends indicate that real estate investors are increasingly looking towards both residential and commercial real estate opportunities. The surge in the stock market has led to a corresponding increase in investment activities within the real estate sector, as individuals look to diversify their portfolios and secure tangible assets.

- Notably, commercial real estate for sale is gaining traction, with businesses seeking new locations to capitalize on economic growth.

4. Key Economic Indicators

- Factors such as stable exchange rates, lower inflation expectations, and improved investor sentiment significantly contribute to a favorable environment for real estate investments. The anticipated easing of monetary policy may further stimulate borrowing and investment in the real estate market.

Impact of the PSX Update on Real Estate

The positive performance of the KSE-100 index has a cascading effect across the economy, particularly affecting the real estate sector in several ways:

1. Investor Confidence

- A thriving stock market enhances investor confidence, making individuals more willing to invest in real estate. This uptick in confidence is evident in the rising number of transactions and interest in new developments.

2. Increased Development Projects

- With greater financial backing, real estate developers are ramping up their activities, launching new residential and commercial projects to meet the growing demand. This development not only boosts the economy but also creates job opportunities in construction and related sectors.

3. Enhanced Financing Options

- As the economic environment stabilizes, financial institutions are more likely to offer favorable lending terms for real estate investments. This accessibility to capital allows more potential buyers and investors to enter the market.

How to Invest in Real Estate

For those considering entering the real estate investment world, here are some practical tips on how to invest in real estate effectively:

1. Research the Market

- Utilize real estate websites to gather data on property prices, market trends, and neighborhood statistics. This information can guide your investment decisions.

- Keep an eye on real estate news to stay updated on market changes and opportunities.

2. Engage a Real Estate Agent

- Working with a knowledgeable real estate agent can simplify the process. They can provide insights into the best properties and help negotiate deals.

- Real estate agents are also valuable for understanding local market dynamics and trends.

3. Evaluate Different Types of Investments

- Consider various forms of real estate investments, such as residential, commercial, or industrial properties. Each has its own risk and return profile.

- Look into commercial real estate options, which can offer higher yields compared to residential properties.

4. Understand Financing Options

- Familiarize yourself with different financing methods, including mortgages, loans, and partnerships. Understanding your financing options can help you make informed decisions.

5. Start Small

- For new investors, starting with smaller properties can minimize risk. Once you gain experience and confidence, you can explore larger investments.

Challenges in the Real Estate Sector

While the outlook is largely positive, there are challenges that real estate investors should be aware of:

1. Documentation Issues

- Many deals in the market still happen informally. It’s crucial to ensure proper documentation to avoid legal issues in the future.

- Working closely with a reliable real estate agent can mitigate these risks.

2. Market Regulation

- The government is making strides in improving regulations. However, the market still faces issues like lack of standard pricing and transparency.

- Staying informed about regulatory changes is essential for investors to navigate potential challenges.

3. Economic Fluctuations

- Economic conditions can change rapidly. Investors need to be prepared for fluctuations in property values and demand.

- Keeping an eye on economic indicators, such as inflation rates and interest rates, can help in making timely decisions.

The Role of Real Estate Developers

Real estate developers play a crucial role in shaping the landscape of the real estate sector. They are responsible for:

1. Creating New Opportunities

- Developers are essential in responding to market demand by building new homes and commercial spaces.

- Their projects can significantly impact local economies by creating jobs and fostering community development.

2. Innovating Designs

- Modern designs and sustainable practices are becoming increasingly important. Developers are now focusing on eco-friendly buildings that appeal to environmentally conscious buyers.

3. Risk Management

- Developers must navigate various risks, from financial challenges to regulatory hurdles. Their ability to manage these risks can determine the success of a project.

MGI Paradise – Real Estate Project

Medic Galleria International (MGI) is a pioneering force in the real estate sector, transforming the concept of luxury living, innovation, and community integration. With a robust footprint in both the UK and Pakistan, MGI specializes in contemporary urban development, artfully merging residential and commercial properties with lifestyle enhancements to foster lively communities.

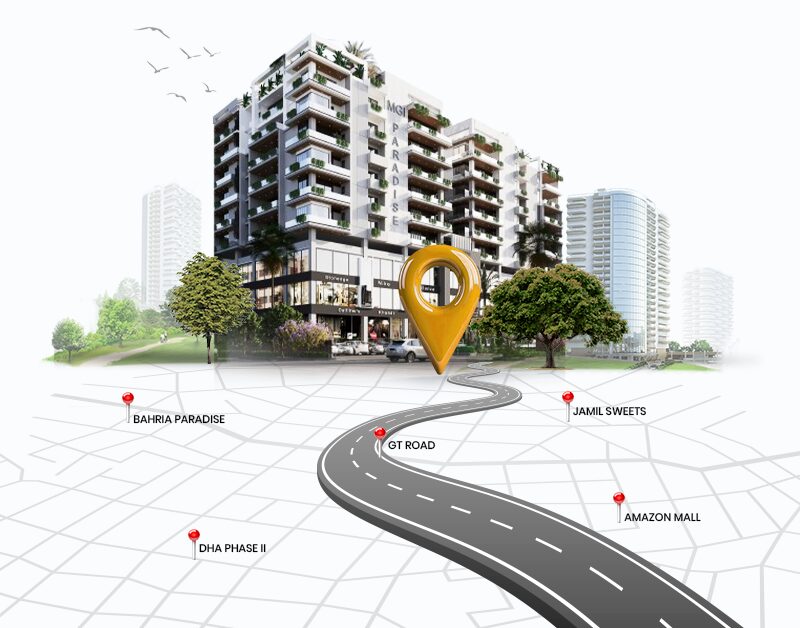

At the forefront of MGI’s ventures is its flagship project, MGI Paradise, an impressive 10-story structure situated in the esteemed Bahria Town Islamabad. Covering 4 kanals, this remarkable development redefines opulence, featuring a rooftop hotel, luxurious apartments, executive offices, and upscale commercial spaces. MGI Paradise is adorned with more than 20 top-tier amenities, such as infinity pools, state-of-the-art fitness centers, and round-the-clock security, ensuring an extraordinary living experience.

Conveniently positioned near significant attractions like Bahria Town Paradise, the project provides effortless access to shopping, dining, and entertainment options. For prospective property buyers in Islamabad, MGI Paradise presents an unparalleled opportunity to invest in a coveted location. MGI’s dedication to excellence has earned it a reputation as a reliable name in the industry, establishing new standards for quality and innovation in real estate. Whether you are an investor or a potential homeowner, MGI Paradise offers a distinctive combination of luxury, convenience, and investment prospects in the vibrant heart of Bahria Town Islamabad.

Conclusion

In conclusion, the developments in the real estate sector following the PSX KSE-100 index update signify a vibrant and growing market. With the right knowledge, resources, and support from real estate agents, both new and seasoned investors can navigate this promising landscape. As the demand for residential and commercial real estate continues to rise, projects like MGI Paradise which is situated in Bahria town and 0 km from GT road Rawalpindi, Islamabad with 22 km from Ring road. MGI represents the future of luxurious living and investment in Pakistan’s thriving real estate market.